Health Equity

News, Statements, and Testimony on Health Equity Issues

25th Council session information coming soon.

-

Alert from DHCF on Lead Screening and Reporting Requirements

Alert from DHCF on Lead Screening and Reporting RequirementsNovember 1, 2023

Learn more about requirements for patients with lead exposure or potential exposure.

Continue Reading -

Issues on 719A Form (Prior Authorization) for DC Medicaid patients

Issues on 719A Form (Prior Authorization) for DC Medicaid patientsOctober 23, 2023

Dr. Arrel Olano talks about how he and MSDC worked together to solve a prior authorization "requirement".

Continue Reading -

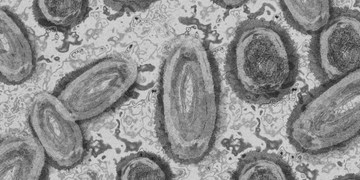

MSDC Seeks Infection Control Experts for Video Series

MSDC Seeks Infection Control Experts for Video SeriesOctober 19, 2023

The videos will be part of MSDC's work for Project Firstline.

Continue Reading

Sample of Health Equity Legislation MSDC Tracked

What does it say? The bill allows for the administration of medicinal marijuana in schools as well as allows students to bring sunscreen to schools and apply it without a prescription.

MSDC position: MSDC supports the language permitting sunscreen application in schools

Current status: A win for DC physicians and public health! The legislation passed the Council in February and was signed by the Mayor. Previous temporary and emergency legislation permitted students to use sunscreen at schools this school year already.

What does it say? The bill requires DC Health to establish an electronic Medical Order for Scope of Treatment registry (eMOST).

MSDC position: MSDC supports this legislation to more easily allow patients to make their treatment orders known.

Current status: A win for the physician community and our patients! The Council passed the bill in December and the Mayor signed it into law on January 16, 2020.

What does it say? The bill would implement a 1.5 cent per ounce tax on the distribution of "sugary" beverages. The money collected from the tax would establish a Healthy People, Healthy Places Open Spaces Grant Program.

MSDC position: MSDC sent a letter to Council Chair Mendelson asking for a hearing to discuss all of the issues around a beverage tax.

Current status: The bill was introduced October 8, 2019 and referred to the Committee on Business and Economic Development and the Committee of the Whole.